Discover Financial Services Cloud

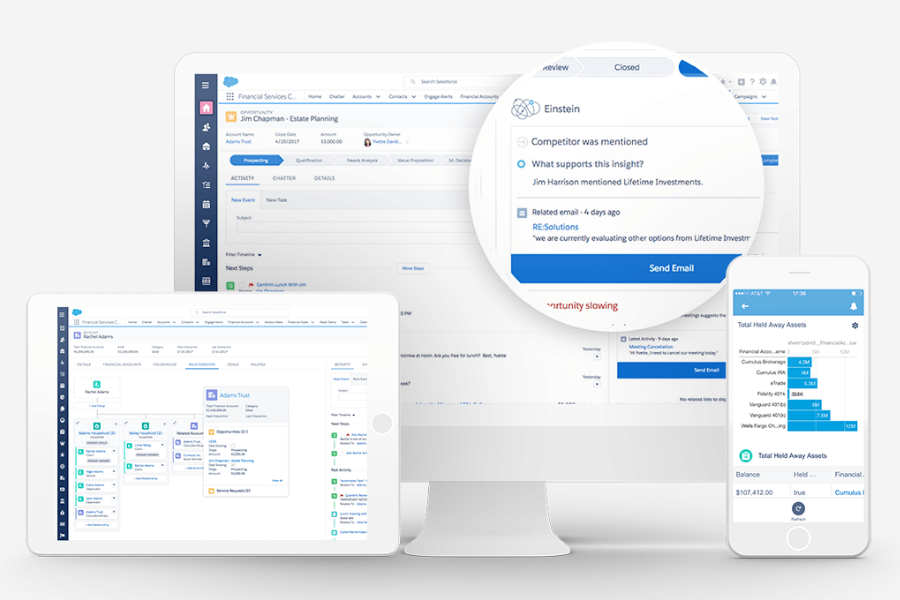

Salesforce introduced Financial Services Cloud back in 2016 for the Wealth Management, Banking and Insurance industries. Financial Services Cloud provides additional functionality (through both extra features and a financial-services-specific data model) to the core Sales Cloud or Service Cloud CRM products.

In this blog, we take a more detailed look at who it’s for, what’s included and some considerations for implementing Financial Services Cloud (FSC).

Core Benefits of the Financial Services Cloud:

- 360-degree view of customers

- Connected end-to-end processes

- Best-in-class Partner Ecosystem

Who is Financial Services Cloud for?

The Financial Services Cloud product is targeted at three main groups within the Financial Industry: Wealth Management, Banking & Insurance. Within Financial Services Cloud, there are specific features and parts of the FSC data model which are tailored to each of these industries and deliver specific benefits.

Financial Services Cloud for Wealth Management

For Wealth Management, the benefits of Financial Services Cloud are extensive but focus on providing the toolset for Financial Advisers to build relationships with clients, improve productivity, and identify gaps in the advice (and products) provided.

The Financial Services Cloud Data Model provides the foundation for this, surfacing both Financial Accounts and Client Goals, and displaying this alongside an enhanced data model for relationships, allowing advisers to see, for example, who makes up a household, or which other professionals may be advising the household.

All of this is surfaced within a number of Financial Services Cloud-specific UI components.

Financial Services Cloud for Banking

Salesforce segment the FSC Banking product into four areas; Retail Banking, Business Banking, Mortgage Banking and Premier Banking.

The Retail & Business Banking offerings focus on improving customer experience and agent productivity (think a Banking-specific Service Cloud).

The Mortgage Banking offering focuses on extending this relationship and how mortgage providers can better work with brokers through Communities. Finally, the Premier Banking offering is more akin to the Wealth Management set-up, allowing a personal, tailored service to be offered to high-value clients.

In practice, all of these can be provided through a single Financial Services Cloud instance, allowing for an accurate single-customer view irrespective of what stage of the customer journey an individual is currently part of.

Financial Services Cloud for Insurance

Finally, the Financial Services Cloud offering for Insurance enhances the experience offered to customers from quote through to claim. Insurance agents and reps are presented with everything they need to accurately and efficiently manage interactions, allowing them to focus on offering the best possible service.

Consleague has an ever-growing and impressive list of Financial Services clients, and we would love you to be our next one. Read our case studies to learn more about how we work with our Financial Services clients.

If you would like to discuss the benefits of the Financial Services Cloud, then schedule a call with one of our Solution Experts and discover how we can transform your business.

We can also provide a Discovery Mapping Programme that takes a comprehensive look at your business and gives expert advice on how to integrate Salesforce into your operations.

Read more about Salesforce for the Financial Industry

Free eBook – CRM for Financial Services

Download our free ebook to learn how CRM has digitally transformed the financial services industry.

Find out how this benefits wealth managers and investment/financial advisors and their clients.

Source: https://www.inardua.co.uk/